The extended deadline to file Form 1065 is September 15, six months after the deadline.

While the initial deadline is March 15, most partnerships need extra time to file their tax returns. When is Form 1065 due?įorm 1065 is due within three months following the end of the calendar year, so, the deadline is March 15. Form 1065 is simply the tax return of partnerships.

Like individuals, partnerships are required to provide the Internal Revenue Service with their income and determine how much they’re going to pay in taxes.

#1065 tax instructions pdf#

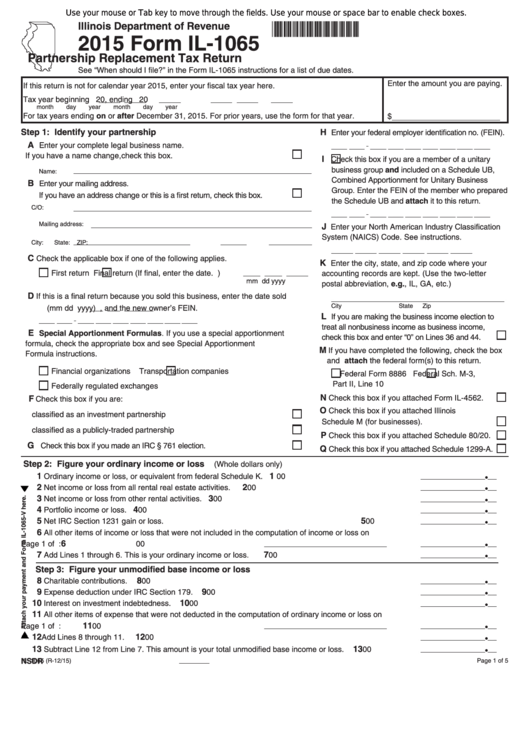

If you’re planning on filing this electronically, you’ll need to file Form 1065 with a tax preparation service as we only offer a PDF filler to file the tax forms you need.įorm 1065 is the tax return of partnerships. You can fill out Form 1065 online through the TaxUni PDF filler, but this only works for those who are preparing a paper application. It’s always best to speak to a professional tax preparer to maximize return on your income tax return.

#1065 tax instructions how to#

How to file Form 1065?įiling Form 1065 is quite complicated as there is a lot that goes into filing it. Due to the form requiring a lot of attention, we also advise you to speak to a professional tax preparer to either look at your return or file for you. We highly suggest not to file Form 1065 without looking at the instructions to file. We highly suggest reading the IRS’ instructions as it details everything from deductions to payment to anything that needs to be reported on the form.

#1065 tax instructions full#

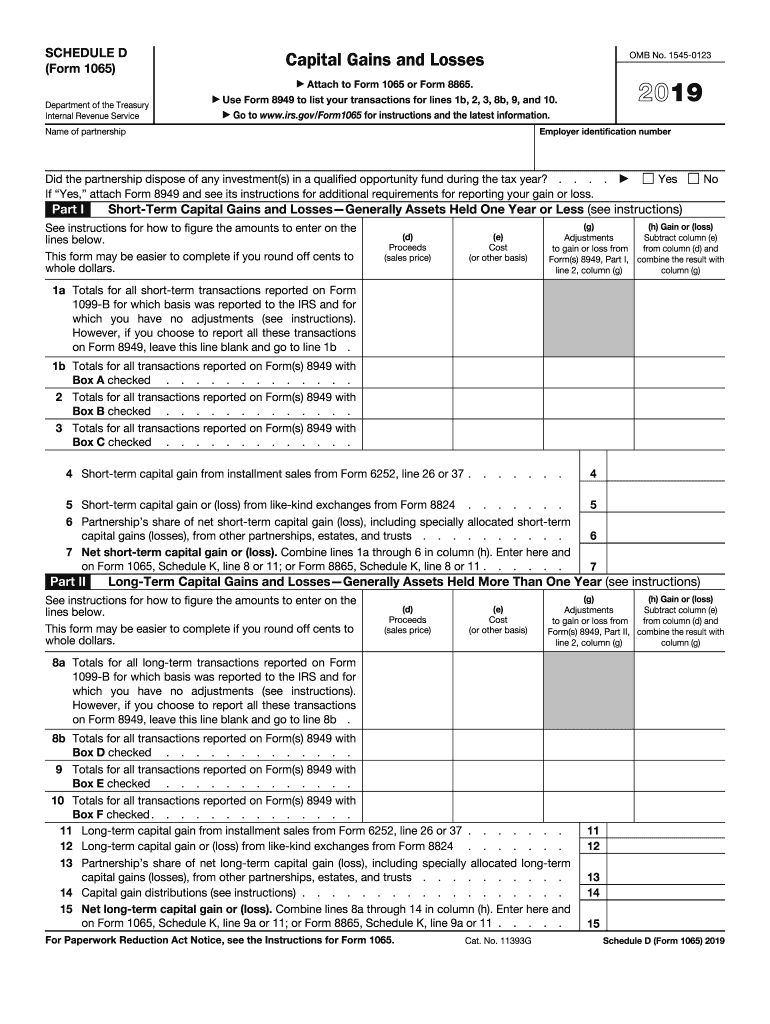

A full guide to filing Form 1065įorm 1065 is a long-formatted form that can take countless hours to prepare, even when you have the necessary information to file it. You’ll also provide the Internal Revenue Service with certain things about your business, including accounting method, the type of return you’re filing, and information about other attachments. On the first page, you will report income, claim deductions, add in taxes paid, and determine tax liability. The first page of Form 1065 is quite simple but you’ll need to make plenty of information gathering in order to determine how much you’re going to pay in taxes.

The instructions to file Form 1065 for the 2021 – 22 tax year is down below. They are considered as pass-through tax entities that must file Form 1065 to report income and tax liability to the Internal Revenue Service. The partnerships aren’t taxed separately from their owners. Form 1065 is the five-page-long income tax return for partnerships.

0 kommentar(er)

0 kommentar(er)